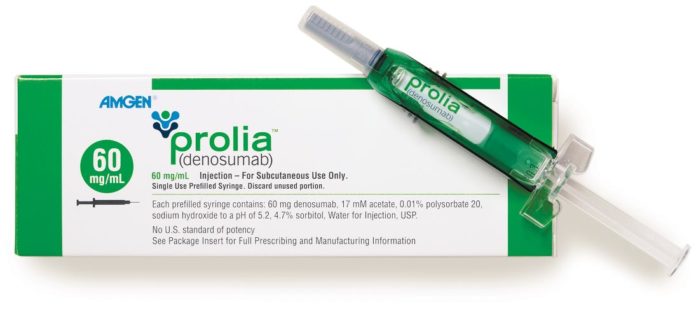

Federal regulators’ approval of Amgen Inc.’s anti-osteoporosis drug, Prolia, marks an important milestone for the biotech company which has struggled with slowing sales of its top selling drugs in recent years. Following the Food and Drug Administration’s announcement June 1 approving Prolia for use by postmenopausal women who face a high risk of bone fractures, Amgen stock climbed as analysts projected the drug could bring in billions of dollars in revenue for the Thousand Oaks company. “We increasingly like this drug’s chances to be one of biotech’s strongest new products in several years,” read one report by the private equity firm Robert W. Baird & Co. An equity research report issued by Barclay Capital analysts projected $1 billion in 2013 US Prolia osteoporosis sales. Prolia, with the generic name of denosumab, is the first and only approved therapy that specifically targets the cells that break down bone. The drug, which will cost $825 per injection, is to be administered as a shot once every six months, and is meant to increase bone mass and strength, according to Amgen. Prolia has enormous potential to reach a large market of women who have postmenopausal osteoporosis, according to the company. “Of the estimated 5.5 million treated postmenopausal osteoporotic women in the U.S. today, many are at high risk for fracture, and these fractures can have severe clinical consequences,” said Amgen spokesperson Sarah Reines in an email. “Prolia has the potential to fill an important clinical need for these patients.” According to the FDA, one of every two women over the age of 50 will break a bone in their lifetimes because of osteoporosis, which causes bones to become brittle. “While this is an important milestone for Amgen, it is even more important for the postmenopausal patients with osteoporosis who are at high risk for fracture,” said Robert A. Bradway, president and chief operating officer of Amgen, in a statement. “We have priced Prolia responsibly and expect to make it commercially available in the U.S. within the next week.” The drug denosumab, which has been in development for 15 years, has even wider potential in the area of oncology as a treatment for bone metastasis, according to analysts. “The real market opportunity is in oncology and I’m pretty sure Amgen knows that,” said Eric Schmidt, a research analyst at Cowen and Co. Amgen filed for FDA approval of denosumab for the treatment of bone metastases in mid-May. “The drug is the most potent of bone building agents, oncology is a more dynamic market and it requires a more aggressive treatment,” Schmidt said. The drug’s adaptation in the osteoporosis market will be gradual due in part to the fact that osteoporosis is not a life threatening illness and many women will not be compelled to immediately change their current treatments, said Schmidt, who projected revenue for the osteoporosis drug to reach between $500 – $600 million. Billion-dollar potential “The drug has a $1- $2 billion potential in oncology,” he added. There’s no question Prolia will be vital in driving Amgen’s future growth. The biotech giant, which in 2009 had revenues of $14.6 billion, has seen sales of its former top selling drugs decline while facing complications with safety and reimbursement issues. Unfavorable studies of its blockbuster anemia drugs Aranesp and Epogen, which account for 60 percent of the company’s profit, and increased competition for its anti-inflammatory drug Enbrel, constitute only a portion of Amgen’s recent troubles. The company has also battled lawsuits following an investigation into a nationwide kickback scheme to boost sales. In 2007 the company underwent a major restructuring that involved laying off as many as 15 percent of its workers. The safety issues involving the anemia drugs, “really complicated and changed the dynamic of the company and the stock,” said Schmidt. “The stock was pushing $70 – $80 dollars a share back in 2007 and they lost their mayor driver of growth which was Aranesp. Sales in the U.S. have more than cut in half.” Losing protection The fact that Amgen’s key products are slated to lose patent protection in the next few years is another reason why many analysts believe Prolia is the future of Amgen. “The clinical results on denosumab so far are positive for the company, and reinforce our belief that the drug could be a blockbuster,” said a report by Zachs Investment Research Inc. The FDA approval comes nearly 2 months ahead of an expected action date of July 25. Amgen originally filed for U.S. approval in December 2008, but was notified by the FDA in October that they would need to submit additional information. The early decision could boost the company’s full-year revenues. Prolia was approved in the European Union on May 28. European regulators have also already approved denosumab for bone loss related to prostate-cancer treatment.