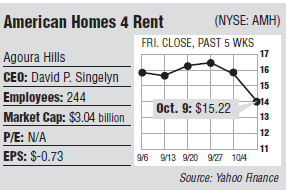

Things haven’t gone as well for American Homes 4 Rent as it might have liked since its closely watched IPO this summer. The single-family landlord – like others in the industry that mushroomed since the housing bust – has struggled to turn a profit as rental payments fail to keep pace with acquisition costs. In its first earnings report since going public, the Agoura Hills real estate investment trust reported a net loss of $14 million, despite its revenue skyrocketing to $18.1 million from $182,000 a year earlier. Now, the stock trades just a few cents below its IPO price of $16 per share, closing Oct. 9 at $15.22. What’s more, American Homes laid off 15 percent of its 684-employee work force in August, according to a Bloomberg News report. But none of this has surprised Anthony Paolone, a research analyst at JP Morgan Chase & Co. in New York who believes investors should exercise some patience. “It’s not like a gain was expected. For a period of time, they’re going to run a loss,” he said. “I don’t really think of that quarter being any concern. There’s a ramp-up with these types of businesses. But as far as investor sentiment toward this idea, it’s still in very much in the ‘show me’ mode.” American Homes’ business involves buying up often-vacant homes in less-than-stellar condition, which means the company not only has to fund the acquisition but also rehab costs before it event starts to rent its properties. And it can routinely take several months for a tenant to be placed. But it’s not only short-term challenges at issue. There is also the matter that rising housing prices would seem to raise the company’s acquisition costs and thereby limit its growth. “The degree of skepticism among investors is around if this is a business you can operate successfully long-term,” said Haendel E. St. Juste, an equity research analyst at New York investment bank Morgan Stanley. “There is a perception that it’s a complex business model and it’s certainly true. It’s a very complicated business.” Deep pockets American Homes was co-founded by B. Wayne Hughes, the billionaire founder of Public Storage Inc. in Glendale. He founded American Homes in 2011 with a group of executives from Public Storage, a company he started in 1972. American Homes went public July 31 in an IPO that raised $887 million before discounts and offering costs from underwriters, who exercised rights to acquire additional shares. American Homes did not return calls or emails seeking comment. But in its earnings release in August, Chief Executive David P. Singelyn displayed optimism and said the transition to a publicly traded company will fuel future growth. “We believe that our new public platform will provide us opportunities for the continued expansion of our business across many fronts,” he said. American Homes is the second-largest owner of single-family homes in the U.S., with 19,825 properties as of July 31, and the number has been growing regularly. New York private equity firm Blackstone Group LP is the largest landlord with more than $64 billion in real estate assets under its management and more than 32,000 homes. Others that have gone public include Minnetonka, Minn. firm Silver Bay Realty Trust Corp., which raised $245 million in December, and Scottsdale, Ariz. firm American Residential Properties Inc., which raised $288 million in May. Both Silver Bay and American Residential have struggled since going public, with share prices down about 15 percent since their IPOs. What’s more, Colony American Homes Inc. of New York, backed by L.A. billionaire Thomas Barrack Jr.’s Colony Capital, was scheduled to price its offering this summer, but postponed it. “I think American Homes stands out as the blue-chip among this sector,” said Paolone, the JP Morgan Chase analyst. “It has great sponsorships with Wayne Hughes.” American homes has continued to add to its portfolio, buying 4,778 properties from a joint venture with the Alaskan Permanent Fund Corp. in Juneau – a major boost to its portfolio that accounted for much of its 176 percent year-over-year revenue increase in the second quarter. Growth potential? However, Richard Green, director of the USC Lusk Center for Real Estate, said there will be a shaking out process for the recently expanding institutional landlord sector. While houses were available at great rates during the recession, that time may be soon ending. “This was sort of a once-in-a-lifetime opportunity. Long term, I don’t expect this to be a crowded business,” he said. “Renting is much more attractive than it was a year ago with home prices going up, but we’re already starting to see a bit of a flattening out.” Paolone didn’t disagree with Green’s analysis, noting that rising home prices are a double-edged sword for American Homes. “If the home prices keep going up, their portfolio goes up in value,” he said. “But it also makes it more difficult to grow because they may not want to keep buying as the prices rise and that may limit the acquisitions.” In fact, last month, American Homes diverged a bit from its core business and moved into the distressed debt market, partnering with a unit of real estate capital advisory firm Johnson Capital in Irvine to buy mortgages. The total value of the fund was not disclosed. Still, Paolone, who has an $18 price target on the stock, said he was optimistic that the company’s core business is solid. St. Juste, who also has an $18 price target, seconded that. “This is a new sector and it’s going to take time,” he said. “This is a very attractive investment class and there is a good long-term opportunity.”